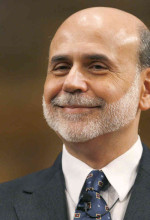

Since the summer, financial experts continued to repeat themselves that the Federal Reserve was going to taper its $85 billion per month bond-buying initiative this month. Fed Chairman Ben Bernanke kept hinting at it and even noted that it might not taper its quantitative easing program if the economic data didn’t support such a move. Despite the warnings, CNBC, CNN … [Read more...]